City planning tax is an earmarked tax used to cover expenses for city development/maintenance and other costs, and is used to enhance and strengthen city development, in particular sewage, parks, community roads, schools, hospitals, measures for small and medium-sized rivers, and measures against high tides. In principle, it is levied on individuals who own land or buildings in urbanization promotion areas designated under the City Planning Act. City planning tax applies to the same land and buildings subject to fixed assets tax. Although, similar to fixed assets tax, this tax is a municipal tax, but the Tokyo Metropolitan government collects this as metropolitan tax in the 23 special wards as an exceptional measure.

[Taxpayers]

Those who are registered in the fixed assets tax ledger as owners of land and/or buildings as of January 1

[Tax payment]

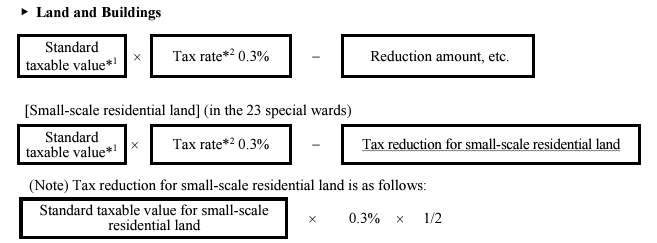

*1 Price registered in the fixed assets tax ledger.

*2 The tax rate varies depending on the district .

[Due date and procedures for tax payment]

In principle, taxpayers shall pay the tax four times a year in June, September, December, and February based on the Tax Notice that is sent in the first tax due month (June). (For due dates on tax payment in each city, town, or village municipality, see Page 103.) City planning tax is levied in conjunction with fixed assets tax on land and buildings. The Tax Notice states both the city planning tax amount and the fixed assets tax amount.

Standard Taxable Value on Land

●Standard Taxable Value

Standard taxable value is the price registered in the fixed assets tax ledger. Concerning land, however, the following special measures regarding the standard taxable value or the measure to adjust the tax burden relating to residential land may be applied.

●Tax Exemption Limit

For land and buildings where the fixed assets tax is below the tax exemption limit, city planning tax is not levied.

●Special Measures regarding the Standard Taxable Value Applied to Residential Land

The special measure regarding the standard taxable value is provided for city planning tax as same as fixed assets tax.

●Measures to Adjust the Tax Burden for Residential Land

The tax burden levels similar to those for fixed assets tax are applied, and the measures to adjust the tax burden have been taken.

●Reduction/Exemption related to Small-scale Residential Land

The Tokyo Metropolitan Government reduces 1/2 of the city planning tax amount pertaining to small-scale housing land lots (housing lot up to 200 m2 per house).

●Reduction under Ordinance on Alleviation of Maximum Burdens Pertaining to Commercial Land

Reduction under Ordinance on Alleviation of Maximum Burdens Pertaining to Commercial Land (Reduction under the Item 2 of Article 15 of Bylaw to Metropolitan Tax Ordinance)

Following last fiscal year, the reduction measure has been taken to bring down the standard taxable value (the upper limit of burden level) for fixed assets tax and city planning tax applicable to commercial lands or the like (including residential lands not used for housing) from 70% to 65% based on the Ordinance.

●Reduction under Ordinance Applicable to Lands with the Tax Amounts of more than 110% over the Previous Fiscal Year

Reduction under Ordinance Applicable to Lands with the Tax Amount of more than 110% over the Previous Fiscal Year (Reduction under the Item 3 of Article 15 of Bylaw to Metropolitan Tax Ordinance)

With a view to restraining a drastic increase in tax amount along with the rise of land prices, a measure is taken in which if the amount of fixed assets tax and city planning tax exceeds the product of multiplication of the pertinent tax amount for the last fiscal year by 1.1, the exceeding amount is reduced under the pertinent ordinance. Note that where the prices change as a result of land tract subdivision/consolidation, or when the land certification has changed due to changes in the land use, the tax amount may surpass 110% of the amount in the previous fiscal year.

●Reduction/Exemption Applicable to Small-scale Non-residential Lands.

Following the last fiscal year, fixed assets tax and city planning tax on the part up to 200 m2 out of a non-residential land whose area per lot is not more than 400 m2 is reduced by 20%. However, this reduction applies only to property owned by an individual or a corporation whose equity capital or investment is not more than ¥100,000,000. To each taxpayer who will newly benefit from this measure, an application form will be sent. (Deadline of application filing: December 28, 2023 (R5)). In order to obtain reduction/exemption, it shall be required to apply to the Tokyo Metropolitan Taxation Office for each ward where the owned land is located. However, those who received a reduction/exemption in FY2022 (R4) in the same ward need not reapply this year.

●Reduction/Exemption Applicable to Land After the Demolition of Old Houses in Specific Fireproofing Districts

In order to prevent the occurrence of large-scale urban fires or a decline in city functions during an earthquake disaster in the Tokyo Metropolis, among the districts having densely built-up residential areas consisting of wooden houses, the Metropolitan Government has designated those which are deemed to be in particular need of improvement as Promotion of Fireproofing Specific Development Districts (hereinafter referred to as “Specific Fireproofing Districts”), and is implementing measures together with the wards to promote fireproofing. One of the forms of special support provided for Specific Fireproofing Districts is an 80% tax reduction for a maximum of five fiscal years in the fixed assets tax and city planning tax imposed on land that has been cleared of old houses for fireproofing purposes, bringing it to the same level as land for residential houses.

●Reduction/Exemption for Rebuilding for Greater Anti-earthquake Resistance

When buildings that existed before January 1, 1982 (S57) are demolished and replaced with new residential buildings by March 31, 2024 (R6), the full amount of fixed assets tax and city planning tax for the residential space on the new building will be reduced/exempted (in case the tax reduction on a newly built residential building under the Local Tax Act is applicable, the tax amount after reduction is applied) for three fiscal years from the new year of taxation after the completion of the new buildings. (The number of houses subject to reduction/exemption shall differ with the conditions of the building before rebuilding.) In the case of the purchase of a newly built condominium, the taxpayer will still be eligible if the necessary requirements are met.

・Requirements for reduction/exemption

1) The proportion of the residential space of the newly built building is not less than 1/2 of the building.

2) The residential building was newly built not earlier than one year before or not later than one year after the demolition of the building to be rebuilt.

3) Both the building to be rebuilt and the rebuilt residential building are in any of the 23 special wards.

4) On January 1 of the year following the year in which the day of new residential building construction belongs (if newly built on January 1, the same day of the same year), the same owner as that of the building on January 1 of the year in which the day of old building demolition belongs owns the new residential building.

5) A certificate of completed inspection has been issued for the newly built residential building.

6) An application has been filed using an “application form for reduction/exemption of fixed assets tax” not later than the end of February of the second year after the new construction (the immediately next year if newly built on January 1).

* Even those for whom these are not applicable may be considered eligible if they fulfill a certain set of requirements. For more information, please consult the Metropolitan Taxation Office of the ward where the rebuilt residential building is located.

●Reduction/Exemption for Residential Building Renovation for Greater Anti-earthquake Resistance

For buildings that existed before January 1, 1982 (S57), if earthquake proofing repair work is undertaken to meet the current quakeproofing standards based on the Building Standards Act by March 31, 2024 (R6), the full amount of fixed assets tax and city planning tax (the tax amount after application of the reduction for residential building renovation for greater anti-earthquake resistance under the Local Tax Act) will be reduced/exempted (to the limit of an equivalent of 120 m² of the residential space per house) for one fiscal year* in the fiscal year following the date of completion of the renovation. (If the construction completes on January 1, the tax reduction/exemption starts in that fiscal year.) * For two fiscal years if the residential building, prior to completion of earthquake resistance renovation, was a non-compliant earthquake resistance building with risk of blocking traffic in case of an earthquake, as stipulated in the Act for Promotion of Seismic Retrofitting of Buildings.

・Requirements for reduction/exemption

1) The proportion of the residential space of the building renovated for greater anti-earthquake resistance is not less than 1/2 of the building.

2) The amount of cost of renovation for greater anti-earthquake resistance is not less than ¥500,000 per house.

3) A certification of work satisfying anti-earthquake standards has been issued for the renovated building.

4) An application has been filed using an “application form for reduction/exemption of fixed assets tax” within three months from the day of completion of renovation work.

●Reduction/Exemption Applicable to Rebuilding for Fireproofing Purposes in Specific Fireproofing Districts

As one of the special support measures for the Specific Fireproofing Districts system, residential buildings that have been rebuilt for fireproofing purposes will be reduced/exempted from the full amount of fixed assets tax and city planning tax for the residential space (in case the tax reduction on a newly built residential building under the Local Tax Act is applicable, the tax amount after reduction is applied) for five fiscal years from the new year of taxation after the completion of the new buildings. (The number of houses subject to reduction/exemption shall differ with the conditions of the building before rebuilding.) In the case of the purchase of a newly built condominium, the taxpayer will still be eligible if the necessary requirements are met.

・Requirements for reduction/exemption

1) The proportion of the residential space of the rebuilt building is not less than 1/2 of the building.

2) Both the building to be rebuilt and the rebuilt residential building are located in the Specific Fireproofing District.

3) The building to be rebuilt is aging building which have exceeded 2/3 of its expected lifetimes.

4) The building to be rebuilt is demolished during the period designated as the Specific Fireproofing District, and building loss registration must have been completed. (However, in the case where the building is demolished after the new residential building has been built, the building must be demolished within a year from the date of the erection of the new residential building.)

5) The date of completion of the erection of the rebuilt residential building lies between the date of designation as a Specific Fireproofing District and March 31, 2026 (R8).

6) The rebuilt residential building is fire-resistant buildings, etc. or quasi-fire resistant buildings, etc.

7) On January 1 of the year following the year in which the day of new residential building construction belongs (if newly built on January 1, the same day of the same year), the same owner as that of the building on January 1 of the year in which the day of old building demolition belongs owns the new residential building.

8) A certificate of completed inspection has been issued for the rebuilt residential building.

9) The “Application Form for Reduction/Exemption of Fixed Assets Tax” must be submitted by the end of February of the second year after the completion of the new building (the next year in the case of a new building completed on January 1).

(Note) Even if this is not applicable, some cases may be eligible when certain requirements are met. Additionally, for more details regarding the reduction/exemption requirements, please contact the Metropolitan Taxation Office in the ward where the rebuilt residential building is located.

Special Land Possession Tax

Special land possession tax is a municipal tax levied on those who have acquired or own land over a certain size, and is collected as metropolitan tax in the 23 special wards as an exceptional measure. However, in view of the current economic conditions, new imposition of special land possession tax has been suspended since FY2003 (H15).