While the municipal governments impose taxes on fixed assets in Tama and the island areas, the Metropolitan Government imposes the metropolitan tax on fixed assets in the 23 special wards as an exceptional measure.

Fixed Assets

“Fixed asset” is a general term for land, buildings and depreciable assets, including the followings:

・Land Rice fields, farms, residential land, mineral springs, ponds and swamps, forests, stock farms, wasteland and land for other purposes (miscellaneous land)

・Buildings Residential buildings, stores, factories (including power stations and substations), warehouses and buildings for other purposes

・Depreciable assets Business property such as structures, machinery, equipment, vessels, aircrafts, tools, instruments, fixtures that are subject to depreciation under the Corporate Tax Act or Income Tax Acts, excluding the property subject to motor vehicle tax (category base) or light motor vehicle (category base) (See Pages 30 and 31 for fixed assets tax on depreciable assets.)

[Taxpayers]

Those who are registered in the fixed assets tax ledger as owners of land and/or buildings as of January 1

・Taxpayer Subsequent to Transfer of Assets

In the event that the transfer of ownership of assets is executed on or after January 2, the obligation for paying taxes on the assets is not transferred. Although there may be cases in which the burden of the fixed assets tax is adjusted between the parties based on the sales contract or the like in proportion to the length of period of ownership, such an arrangement would be nothing more than to bind the parties concerned.

[Tax payment]

・Land and buildings

【Standard taxable value*】 × 【Tax rate 1.4%】 - 【Reduction amount, etc.】

*Price registered in the fixed assets tax ledger

[Due date and procedures for tax payment]

In principle, taxpayers shall pay the tax four times a year in June, September, December, and February based on the Tax Notice that is sent in the first tax due month in June. (For due dates on tax payment in each city, town, or village municipality.) For land and buildings, the Tax Notice is accompanied by a detailed specification of tax assessment. For payment methods.

Assessed Value of Fixed Assets

The value of fixed assets is the price that is determined by the prefectural governors or the mayors of city, town or village on the basis of the Standard Valuation Code of Fixed Assets, which was established by the Ministry of Internal Affairs and Communications, and then registered in the fixed assets tax ledger.

Assessed Value of Land and Buildings

Once every three years, an across-the-board revaluation is carried out to determine new prices. The fiscal year of this revaluation is called the basic taxable year, and FY2021 (R3) is one of the basic taxable years. In the second (FY2022 (R4)) and third (FY2023 (R5)) years following the basic taxable year, the prices set in the basic year (FY2021 (R3)) are retained. However, fixed assets are newly assessed to determine new prices, such as in the case of subdivided/consolidated land tracts or newly built, extended or renovated houses.

Tax Exemption Limit

The fixed assets tax is not imposed when the total standard taxable value of fixed assets owned by the same person in the same municipality is less than the following:

Land: ¥300,000 Building: ¥200,000

Definition of Residential Land and its Special Cases

【1】Residential Land is Defined as the Land that Meets One of the Following Conditions as of the Base Date for Assessment (January 1).

(A)The land used as a site for exclusively residential dwelling (residential building used exclusively as dwelling space) with a maximum area 10 times larger than the floor area of the residential building that is actually built on it.

(B)The land used as a site for a dwelling house combined with other use (part of the building is used as dwelling space, and the proportion of dwelling space to the floor space of the residential building* is 25% or more) with the area of site calculated by multiplying the area by the rates shown in the table below.

(However, the area will be the one calculated by multiplying 10 times the size of the residential building by the rates shown below if the land area is more than 10 times larger than the floor area of the residential building located on it.)

| Types of dwelling house combined with other use | Proportion of dwelling space∗ | Rates |

| Residential buildings other than the ones listed below | 25% or more to less than 50% 50% or more | 0.5 1.0 |

| Fireproof residential buildings with five or more stories above the ground | 25% or more to less than 50% 50% or more to less than 75% 75% or more | 0.5 0.75 1.0 |

【2】Special Measures for Standard Taxable Value

Special measures for standard taxable value of residential land have been taken for the land used as house lot so as to lighten the tax burdens. The fixed assets tax on land for residential use to which the special measures are applied (amount of regular standard taxable value) is calculated as shown in the table below according to the type of residential land, fixed assets tax and city planning tax.

| Type of residential land | Fixed assets tax | City planning tax | |

| Small-scale residential land | Residential land with up to 200 m2 per residential building* | Assessed value × 1/6 | Assessed value × 1/3 |

| General residential land | Residential land other than land for small-sized residence | Assessed value × 1/3 | Assessed value × 2/3 |

*Although in principle the number of housing units shall be one unit in one building, in the case where there are a number of independently partitioned parts for residential use, such as single rooms in an apartment, this number shall be taken.

(Note) This is applicable to the “specified vacant house, etc.” in the Law for Special Measures to Promote Dealing with Vacant Houses, although special measures of the standard taxable value shall not apply to sites of houses for which advice had been given from the ward to the owner, etc. but the necessary measures were not taken according to the advice by the day of assessment (January 1).

Declaration of Residential Land

In the following cases, it is necessary to file a “Declaration of Residential Land, etc. for Fixed Assets Tax Purposes” form with the Tokyo Metropolitan Taxation Office having jurisdiction over the ward where the land is located on or before January 31 of the following year.

1) A new residential building is acquired or extended.

2) All or a part of a residential building is demolished.

3) A residential building is rebuilt*1.

4) All or a part of the existing residential building is converted for a different purpose other than residence (e.g. from a house to a shop, or vice versa).

5) Land use is converted (e.g. utilizing land that was previously a garden as a parking lot).

6) A residential building is destroyed or damaged due to disasters, etc.*2

*1 Regarding 3) “A residential building is rebuilt.” As of the date of assessment (January 1), in principle the land on which a residential building is being constructed or where the construction is planned is not regarded as residential land. However, in cases where certain conditions are met, such as when an existing residential building is to be demolished and a residential building is to be rebuilt, the special measures of the standard taxable value are continued to be applied as residential land based on a declaration. For more details and the procedures, please contact the Tokyo Metropolitan Taxation Office (Land Group) having jurisdiction over the land that you own.

*2 Please file a “Declaration of Disaster-Damaged Residential Land for Fixed Assets Tax Purposes” form.

Measures to Adjust the Tax Burden for Residential Land

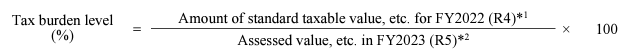

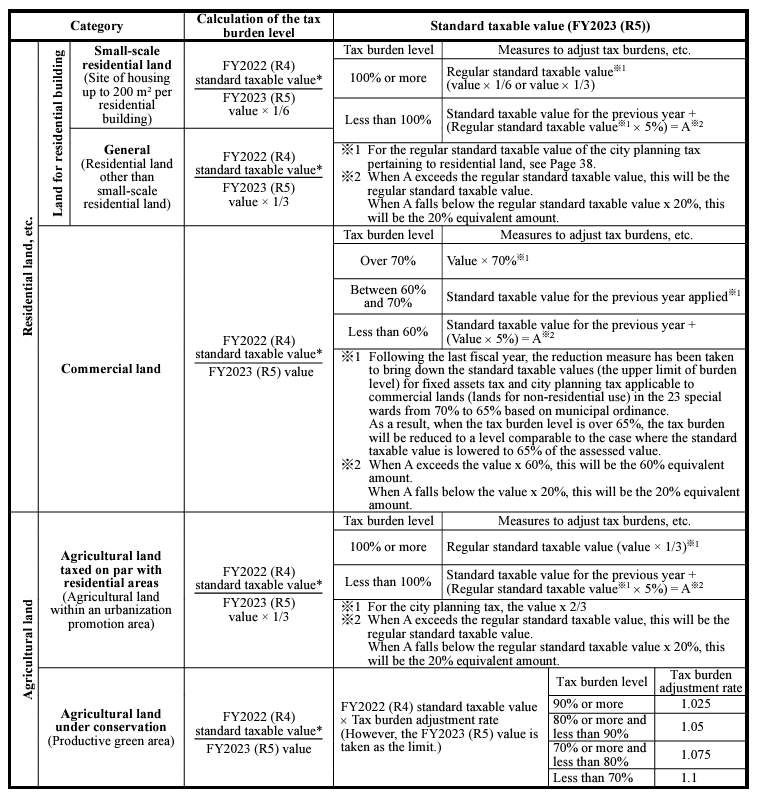

(1)Balancing of Tax Burden Levels

The amounts of fixed assets tax and city planning tax are calculated in principle on the basis of the assessed value or the special measure amount (for residential land, the amount to which the special measures are applied (regular standard taxable value)). As for land, however, in order to contain sudden rises in tax amounts due to revaluation, etc., a standard taxable value reflecting measures to adjust burden levels is used in the calculation. In addition, for non-residential land where tax burden levels are up to 70%, the measure to retain the standard taxable value set in the previous fiscal year will continue, in order to equalize the tax burden level (level of discrepancy between the price and the standard taxable value).

*1 In the case where land was subdivided or consolidated within 2022 (R4), tax will be assessed according to the standard taxable value of FY2022 (R4) for similar land.

∗2 Asset values, etc. refer to any one of the followings:

・Amount to which special measures are applied (regular standard taxable value);

・Agricultural land in urbanization promotion area (assessed value × 1/3); or

・Assessed value in any other cases

(2)Tax Burden on Residential Land and Standard Taxable Value

・Residential land

Tax burden level of 100% or more → Regular standard taxable value (assessed value × 1/6 or assessed value × 1/3)

Tax burden level of less than 100% → Increase gradually

・Commercial land, etc

Tax burden level of over 70% → Reduction to the legal upper limit (70% of the price) of the standard taxable value applied*

Tax burden level of between 60% and 70% → The standard taxable value for the previous fiscal year, etc.*

Tax burden level of less than 60% → Increase gradually

*Following the last fiscal year, the reduction measure has been taken to bring down the standard taxable values (the upper limit of burden level) for fixed assets tax and city planning tax applicable to commercial land, etc. (residential land used for non-residential uses, etc.) in the 23 special wards from 70% to 65% based on the municipal ordinance. As a result, when the tax burden level is over 65%, the tax burden will be reduced to a level comparable to the case where the standard taxable value is lowered to 65% of the assessed value.

Measures to Reduce Tax Burden for Lands (in the 23 Special Wards)

(1)Reduction under Ordinance on Alleviation of Maximum Burdens Pertaining to Commercial Land (Reduction under the Item 2 of Article 15 of Bylaw to Metropolitan Tax Ordinance)

Following last fiscal year, the reduction measure has been taken to bring down the standard taxable value (the upper limit of burden level) for fixed assets tax and city planning tax applicable to commercial lands or the like (including residential lands not used for housing) from 70% to 65% based on the Ordinance.

(2)Reduction under Ordinance Applicable to Lands with the Tax Amount of more than 110% over the Previous Fiscal Year (Reduction under the Item 3 of Article 15 of Bylaw to Metropolitan Tax Ordinance)

With a view to restraining a drastic increase in tax amount along with the rise of land prices, a measure is taken in which if the amount of fixed assets tax and city planning tax exceeds the product of multiplication of the pertinent tax amount for the last fiscal year by 1.1, the exceeding amount is reduced under the pertinent ordinance. Note that where the prices change as a result of land tract subdivision/consolidation, or when the land certification has changed due to changes in the land use, the tax amount may surpass 110% of the amount in the previous fiscal year.

Reduction/Exemption Applicable to Land (in the 23 Special Wards)

The following tax reduction/exemption system is instituted as the own system in Tokyo.

(1)Reduction/Exemption of Fixed Assets Tax and City Planning Tax Applicable to Small-scale Non-residential Lands

Following the last fiscal year, fixed assets tax and city planning tax on the part up to 200 m2 out of a non-residential land whose area per lot is not more than 400 m2 is reduced by 20%. However, this reduction applies only to property owned by an individual or a corporation whose equity capital or investment is not more than ¥100,000,000. To each taxpayer who will newly benefit from this measure, an application form will be sent. (Deadline of application filing: December 28, 2023 (R5)). In order to obtain reduction/exemption, it shall be required to apply to the Tokyo Metropolitan Taxation Office for each ward where the owned land is located. However, those who received a reduction/exemption in FY2022 (R4) in the same ward need not reapply this year.

(2)Reduction/Exemption of Fixed Assets Tax and City Planning Tax Applicable to Land after the Demolition of Old Houses in Specific Fireproofing Districts

In order to prevent the occurrence of large-scale urban fires or a decline in city functions during an earthquake disaster in the Tokyo Metropolis, among the districts having densely built-up residential areas consisting of wooden houses, the Metropolitan Government has designated those which are deemed to be in particular need of improvement as Promotion of Fireproofing Specific Development Districts (hereinafter referred to as “Specific Fireproofing Districts”), and is implementing measures together with the wards to promote fireproofing. One of the forms of special support provided for Specific Fireproofing Districts is an 80% tax reduction for a maximum of five fiscal years in the fixed assets tax and city planning tax imposed on land that has been cleared of old houses for fireproofing purposes, bringing it to the same level as land for residential houses.

●Requirements for reduction/exemption

1)The old houses that are demolished must be aging buildings which have exceeded 2/3 of their expected lifetimes. 2) Old houses must be demolished between the date of designation as a Specific Fireproofing District and March 31, 2026 (R8).

3) After the demolition of the old houses, the land certification must be converted from small-scale residential land to non-residential land.

4) The ward must certify that the cleared land is appropriately managed as an effective space for fire prevention (Land that is undergoing construction works for houses, etc. cannot be certified as effective space for fire prevention.)

5) The owner of the land on the day the old houses were demolished continues to own the land as of January 1 of the year for receiving reduction/exemption.

6) The “Application for Reduction/Exemption of Fixed Assets Tax” must be submitted by the deadline for the first taxation period for fixed assets tax and city planning tax in the fiscal year for receiving reduction/exemption (on June 30 (or on the next working day if this date falls on a Saturday, Sunday, national holiday, or other holiday)).

(Note) For more details regarding the reduction/exemption requirements, please contact the Metropolitan Taxation Office in the ward where the owned land is located.

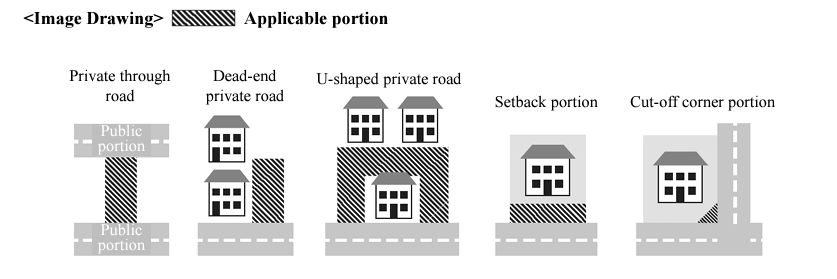

Tax Exemption of Roads (in the 23 Special Wards)

In case the land is used as a road (including the setback portion) and meets the given requirements, according to the stipulation by the Local Tax Act, the part used as the road of such land is not subject to fixed assets tax/city planning tax. In principle, for an application for tax exemption on land is submitted within the year, the Metropolitan Taxation Office will conduct an on-site survey, etc. and if the land is confirmed to be meeting requirements, it will not be subject to taxation from the fiscal year starting in April the following year.

●Main subjects for tax exemption in this system

(1) Roads defined in the Road Act (National expressways, ordinary national roads, Tokyo municipal roads, and ward roads)

(2) Private roads that satisfy the following conditions (Note: Except for land that was calculated as part of the lot area when the house was under construction)

1) It does not have restrictions on use and is available for use by the general public.

2) It has a form that can be objectively certified as a road.

3) Either of the following shall be applicable.

・In the case of a “private through road” (a road in which the start and end points of the road connect to a different public road), the entire length of the road is 1.8 m or more in width.

・In the case of a “dead-end private road” or “U-shaped private road”, the road is used by two or more houses, the land is used exclusively for traffic, and the road is 4.0 m or more in width (1.8 m or more for former roads).

(3) The following pieces of land* that are effectively serving as part of the roads described in (1) or (2) above.

・Setback portion: This is the widened portion of a narrow street, etc. developed by a special ward, where the widened portion, etc. of a road is defined by the stipulations of Article 42 Paragraphs 2, 3 and 5 of the Building Standards Act.

・Cut-off corner portion: Cut-off corner portion as defined by the stipulations in Article 2 of the Tokyo Metropolitan Building Safety Ordinance.

* It is necessary that the boundary of the road portion with the site portion is clearly demarcated with a fence, curb, joint, etc., and that the land does not have restrictions on use.

●Necessary procedures

Submit the following documents to the Land Group of the Metropolitan Taxation Office in the ward where the owned land is located.

・Fixed Assets Tax and City Planning Tax Exemption Application Form (Road for Public Use)

・Drawings which allow precise confirmation of the position and the method for calculating the area of the road portion (e.g., Survey maps, building area plans, etc. which measured the area of the road portion)

Calculation of the Standard Taxable Value (Fixed Assets Tax (in the 23 Special Wards))

*In cases where land was subdivided or consolidated within 2022 (R4), tax will be assessed according to the standard taxable value of FY2022 (R4) for similar land.

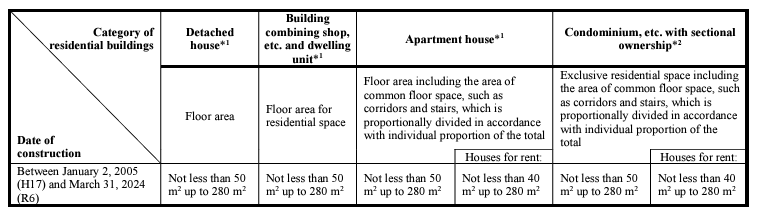

Reduction of Fixed Assets Tax for Newly Built Residential Building

When a newly-built residential building satisfies the requirements for floor space laid out on Page 43, 1/2 of the fixed assets tax (corresponding to up to 120 m2 of residential space per house) can be deducted for a total of three fiscal years beginning with the year in which the property becomes taxable (five fiscal years for residential building with three stories or more that have a fire-resistance or quasi-fire resistance system). Similarly, for a residential building certified as long-term quality housing on or after June 4, 2009 (H21) and satisfying the requirements for floor area laid out on Page 43, 1/2 of the fixed assets tax (corresponding to up to 120 m2 of the residential space per house) can be deducted for a total of five fiscal years beginning with the year in which the property becomes taxable (seven fiscal years for residential buildings with three stories or more that have a fire resistance or quasi-fire resistance system). The tax deduction for certified long-term quality housing requires application by January 31 of the year immediately following the construction of the residential building (the year of construction if construction is completed on January 1).

*1 Limited to cases where the floor area of the living space takes up no less than half of the total floor area.

*2 Limited to cases where the living space of the exclusively owned space takes up no less than half of the exclusively owned space.

(Note 1) Proof of fire protection quasi-systems is required for the wooden houses with three stories or more that fall under the category of residential buildings with a fire protection quasi-system. For this purpose, a “Declaration for a Fixed Assets Tax Deduction” shall be submitted together with an “Application for Confirmation of Construction (copy)” and a “Certificate of Inspection (copy)” or a “Statement of House Performance Evaluation (copy).”

(Note 2) Buildings that have received advice from the ward to promote proper location may be excluded from the deduction subjects. For more details, please consult the Metropolitan Taxation Office in the ward where the asset is located.

Reduction of Fixed Assets Tax Associated with Housing Renovation, etc.

(1) Reduction of Fixed Assets Tax Associated with Renovation for Earthquake Resistant Structures of Housing In case certain seismic retrofitting is done until March 31, 2024 (R6) for homes existing before January 1, 1982 (S57) to meet present earthquake-resistant standards, half the amount of fixed assets tax (limited to a corresponding 120 m2 of living space per house) will be reduced for one fiscal year (two fiscal years for such houses, before retrofitting, was the passage for failure of existing seismic-ineligible buildings stipulated in the Act to Promote Earthquake-Proof Retrofitting of Buildings) from the next fiscal year after the completion date of retrofitting works (if the completion date is January 1, the fiscal year of the retrofitting)*. The requirements for such tax exemption/reduction are same as “Exemption/reduction of fixed assets tax and city planning tax (within 23 wards) for the houses which the seismic retrofitting is done”. See Page 44 for details.

* The reduction will be two-thirds of such tax where the retrofit house is certified as a long-term high-quality house.

※ To take the reduction, an application shall be made within three months of the day of completion of renovation work, together with the specified documents (e.g. the document to prove that the renovation works meet present earthquake-resistant standards).

(2) Reduction of Fixed Assets Tax Associated with Quake-resistance Renovation for Buildings Included in the Safety Verification Plan With regard to the buildings included in the safety verification plan or large-scale buildings requiring emergency safety verification, as stipulated in the Act on Promotion of Seismic Retrofitting of Buildings, through assistance from the government, in the case of renovation works carried out until March 31, 2026 (R8) to ensure compliance with existing quake-resistance standards based on the Building Standards Act, half the amount of fixed assets tax associated with the house in question will be reduced for two fiscal years from the next fiscal year after the completion year of renovation works. (If the reduction amount of fixed assets tax exceeds an amount equivalent to 5% of the construction fees related to the renovation works in question, the reduction would be an amount equivalent to 5% of the fees).

※ To take the reduction, an application shall be made within three months of the day of completion of renovation work, together with the specified documents (e.g. the document to prove that the renovation works meet present earthquake-resistant standards).

(3) Reduction of Fixed Assets Tax Associated with Barrier Free Housing Renovation For residential buildings that have elapsed 10 or more years and whose resident is 65 years of age or older, a person certified as the one requiring nursing care or support under the Long-Term Care Insurance Act or a person with disabilities (excluding rental housing), the fixed assets tax on the house (up to 100 m2 of residential space per unit) will be reduced by one-third for the following fiscal year (or for the same year if the construction work completes on January 1) provided certain repair works to make the residence barrier-free were/are completed by March 31, 2024 (R6).

※ To take the deduction, an application shall be made within three months of the day of completion of renovation work, together with the specified documents (e.g. the document to certify the completion of barrier free housing renovation).

(4) Reduction of Fixed Asset Taxes for Residential Energy-saving (Heat Loss Prevention) Renovation For residential buildings (excluding rental housing) that existed before April 1, 2014 (H26), the fixed assets tax on the house (up to 120 m2 of residential space per house) will be reduced by one-third* for the following fiscal year (if the completion date is January 1, the fiscal year of the renovations), provided certain energy-saving renovations (heat loss prevention) such as insulation retrofitting work on windows were/are completed by March 31, 2024 (R6).

* The reduction will be two-thirds of such tax where the retrofit house is certified as a long-term high-quality house.

※ To take the deduction, an application shall be made within three months of the day of completion of renovation work, together with the specified documents (e.g. the document to prove that each part of the housing after renovation meet the energy saving standard).

(Note 1) For (1) and (3), it is necessary that the amount of cost (the amount after deduction of subsidy, etc. for (3)) for renovation is not less than ¥500,000 per house. For (4), it is necessary that the amount of cost (the amount after deduction of subsidy, etc.) for renovation is not less than ¥600,000 per house.

(Note 2) For (3) and (4), the floor area of the house after renovation must be between 50 m2 and 280 m2.

(Note 3) For the procedures required for the reductions of (1) to (4), please contact the Metropolitan Taxation Office of the ward where the property is located.

Reduction/Exemption Applicable to Residential Buildings (in the 23 Special Wards)

The following tax reduction/exemption system is instituted as the own system in Tokyo.

(1) Reduction/Exemption of Fixed Assets Tax and City Planning Tax for Rebuilding for Greater Anti-earthquake Resistance

When buildings that existed before January 1, 1982 (S57) are demolished and replaced with new residential buildings by March 31, 2024 (R6), the full amount of fixed assets tax and city planning tax for the residential space on the new building will be reduced/exempted (in case the tax reduction on a newly built residential building under the Local Tax Act is applicable, the tax amount after reduction is applied) for three fiscal years from the new year of taxation after the completion of the new buildings. (The number of houses subject to reduction/exemption shall differ with the conditions of the building before rebuilding.) In the case of the purchase of a newly built condominium, the taxpayer will still be eligible if the necessary requirements are met.

●Requirements for reduction/exemption

1) The proportion of the residential space of the newly built building is not less than 1/2 of the building.

2) The residential building was newly built not earlier than one year before or not later than one year after the demolition of the building to be rebuilt.

3) Both the building to be rebuilt and the rebuilt residential building are in any of the 23 special wards.

4) On January 1 of the year following the year in which the day of new residential building construction belongs (if newly built on January 1, the same day of the same year), the same owner as that of the building on January 1 of the year in which the day of old building demolition belongs owns the new residential building.

5) A certificate of completed inspection has been issued for the newly built residential building.

6) An application has been filed using an “application form for reduction/exemption of fixed assets tax” not later than the end of February of the second year after the new construction (the immediately next year if newly built on January 1).

* Even those for whom these are not applicable may be considered eligible if they fulfill a certain set of requirements. For more information, please consult the Metropolitan Taxation Office of the ward where the rebuilt residential building is located.

(2)Reduction/Exemption of Fixed Assets Tax and City Planning Tax for Renovation for Greater Anti-earthquake Resistance

For buildings that existed before January 1, 1982 (S57), if earthquake proofing repair work is undertaken to meet the current quakeproofing standards based on the Building Standards Act by March 31, 2024 (R6), the full amount of fixed assets tax and city planning tax (the tax amount after application of the reduction for residential building renovation for greater anti-earthquake resistance under the Local Tax Act) will be reduced/exempted (to the limit of an equivalent of 120 m² of the residential space per house) for one fiscal year

* in the fiscal year following the date of completion of the renovation. (If the construction completes on January 1, the tax reduction/exemption starts in that fiscal year.)

* For two fiscal years if the residential building, prior to completion of earthquake resistance renovation, was a non-compliant earthquake resistance building with risk of blocking traffic in case of an earthquake, as stipulated in the Act for Promotion of Seismic Retrofitting of Buildings.

●Requirements for reduction/exemption

1) The proportion of the residential space of the building renovated for greater anti-earthquake resistance is not less than 1/2 of the building.

2) The amount of cost of renovation for greater anti-earthquake resistance is not less than ¥500,000 per house.

3) A certification of work satisfying anti-earthquake standards has been issued for the renovated building.

4) An application has been filed using an “application form for reduction/exemption of fixed assets tax” within three months from the day of completion of renovation work.

(3) Reduction/Exemption of Fixed Assets Tax and City Planning Tax for Houses that have been Rebuilt for Fireproofing Purposes in Specific Fireproofing Districts

As one of the special support measures for the Specific Fireproofing Districts system, residential buildings that have been rebuilt for fireproofing purposes will be reduced/exempted from the full amount of fixed assets tax and city planning tax for the residential space (in case the tax reduction on a newly built residential building under the Local Tax Act is applicable, the tax amount after reduction is applied) for five fiscal years from the new year of taxation after the completion of the new buildings. (The number of houses subject to reduction/exemption shall differ with the conditions of the building before rebuilding.) In the case of the purchase of a newly built condominium, the taxpayer will still be eligible if the necessary requirements are met.

●Requirements for reduction/exemption

1) The proportion of the residential space of the rebuilt building is not less than 1/2 of the building.

2) Both the building to be rebuilt and the rebuilt residential building are located in the Specific Fireproofing District.

3) The building to be rebuilt is aging building which have exceeded 2/3 of its expected lifetimes.

4) The building to be rebuilt is demolished during the period designated as the Specific Fireproofing District, and building loss registration must have been completed. (However, in the case where the building is demolished after the new residential building has been built, the building must be demolished within a year from the date of the erection of the new residential building.)

5) The date of completion of the erection of the rebuilt residential building lies between the date of designation as a Specific Fireproofing District and March 31, 2026 (R8).

6) The rebuilt residential building is fire-resistant buildings, etc. or quasi-fire resistant buildings, etc.

7) On January 1 of the year following the year in which the day of new residential building construction belongs (if newly built on January 1, the same day of the same year), the same owner as that of the building on January 1 of the year in which the day of old building demolition belongs owns the new residential building.

8) A certificate of completed inspection has been issued for the rebuilt residential building.

9) The “Application Form for Reduction/Exemption of Fixed Assets Tax” must be submitted by the end of February of the second year after the completion of the new building (the next year in the case of a new building completed on January 1).

(Note) Even if this is not applicable, some cases may be eligible when certain requirements are met. Additionally, for more details regarding the reduction/exemption requirements, please contact the Metropolitan Taxation Office in the ward where the rebuilt residential building is located.

Disclosure of Land Tax Assessment Value

Land tax assessment value refers to the value of land located along roads in urban areas; specifically, it is the value per 1 ㎡ of the standard residential land along the street. The assessed amount of the residential land is calculated based on the land tax assessment value, taking into account the factors such as the depth, dimensions, legal restrictions on use, and so on. In order to make land price assessment more readily understandable to taxpayers, all land tax assessment values for fixed assets tax, which form the basis for assessed values, are disclosed free of charge to the public. For the latest land assessments, etc., please check with the competent Metropolitan Taxation Office.

■Locations for public viewing of land tax assessment maps

| Places where public viewing is possible | 2018 (H30) basic (taxable) year to 2021 (R3) basic (taxable) year Land tax assessment map | 2012 (H24) basic (taxable) year to 2015 (H27) basic (taxable) year Land tax assessment map | 1991 (H3) basic (taxable) year to 2009 (H21) basic (taxable) year Land tax assessment map* | Remarks |

| Tokyo Metropolitan Government Bureau of Taxation website “Land Tax Assessment Public Viewing” (Japanese only) | ○ | ○ | × | |

| Metropolitan Tokyo’s Information Service and Public Information Room | ○ | × | × | Copy service available (Charged) |

| Tokyo Metropolitan Central Library | ○ | ○ | ○ | Copy service available (Charged) |

| Tokyo Metropolitan Taxation Offices in the 23 special wards | ○ | ○ | × | ・Possible to confirm the latest details ・Only possible to view the land administered by the ward ・Lending of information is possible |

*Note that the contents of the 1991 (H3) basic (taxable) year (only representative locations) and the 1994 (H6) basic (taxable) year (only principal roads), which are named the Fixed Assets Tax Land Tax Assessment Public Viewing Register, differ from the contents of the current land tax assessment map.

Current Owner Declaration System (in the 23 Special Wards)

When the owner of land or buildings has died, it is necessary for the person such as the heir who has become the new owner (current owner) to personally declare that he/she is the current owner. Until the name in the real estate register is changed, the fixed assets tax and city planning tax is imposed on the current owner based on the declaration.

●Persons subject to declaration

Persons who have become owners due to the death of an owner of land or buildings are required to make the declaration. When the name registered in the real estate register has been changed due to heir registration, etc., declaration is not necessary.

●Declaration method

Please submit the “Fixed Asset (Land and Buildings) Current Owner Declaration” with the attached documents* to the Metropolitan Taxation Office having jurisdiction over the ward where the land or building is located within three months from the date following the date that you personally became aware that you are the current owner.

* The attached documents comprise the residence certificate, certified copy of family register, written will, etc. as (1) the documents which indicate that the registered owner has died, (2) documents which certify that the person making the declaration is the current owner, and (3) documents certifying the current address of the person making the declaration. For more information, please see the Tokyo Metropolitan Government Bureau of Taxation website (Japanese only) or consult the Metropolitan Taxation Office that has jurisdiction over your area.

●Points requiring care when making declarations

・Although all the current owners are subject to the declaration, it is also possible for a representative to make a declaration incorporating a number of current owners. In this case, it is not necessary for the other current owners described in the declaration to make a declaration.

・In situations such as during discussions on the division of inheritances when there is no division of inheritance agreement, written will, etc., the land or building will be considered as being co-owned by all the legal heirs, all of whom will become the current owners.

・When a current owner has land and buildings in several wards, declarations should be made to the Metropolitan Taxation Offices in each of the wards where the assets are located. For land and buildings located in metropolitan areas outside the 23 special wards, please contact the person in charge in each municipality where the assets are located.

・In the current owner declaration, the name described in the real estate register is not changed. Because heir registration will become mandatory from April 1, 2024 (R6), please complete the registration in good time. Regarding the registration, please make inquiries to the Tokyo Legal Affairs Bureau (Main Office and Branches).

Public Inspection and Public Viewing

(1)Public Inspection of the Books

Public inspection is a system to enable taxpayers to compare the prices of their land/buildings with those of other land/buildings in the same district and to confirm whether or not their fixed assets are appropriately priced. Public inspection is open for a specified period of time (between April 3 and June 30 for FY2023 (R5), excluding Saturdays, Sundays, national holidays, or other holidays, in the 23 special wards) to inspect books listing land and building prices. When viewing the books for public inspection, bring with you a driver’s license or other document to confirm your identity as the taxpayer*.

* See Page 88 for the methods of confirming the identity of applicants during public inspections pertaining to fixed assets tax in the 23 special wards.

(2)Browsing of Fixed Assets Tax Ledger

Taxpayers may check on their assets throughout the year via the fixed assets tax ledger. Leaseholders and tenants (exclusively those paying rent on the property) are allowed to view the information on the ledger related to the relevant leased land/leased residence assets (information on land is also available for viewing in the case of a rented house)1. A document to identify taxpayer, such as a driver’s license, is required in order to view the ledger. Leaseholders and tenants (exclusively those paying rent on the property) should also bring the original copy of their rental contract2.

*1 See Pages 85 to 88 for information on applying for public inspection or public viewing pertaining to fixed assets tax in the 23 special wards.

*2 In the case of sublease right holders, the sublease contract, etc., and the rental contract between the right holder and the leaseholders and/or tenants are needed. In cases where a contract has been entered into with a proxy for the owner, the rental contract between the right holder and the leaseholders and/or tenants and documentation (such as a letter of authorization) attesting to the delegation relationship between the owner and the proxy are needed.

Requests for Examination (in the 23 Special Wards)

Regarding fixed assets tax and city planning tax, in the event of dissatisfaction with the prices registered on the fixed assets tax ledger, it is possible for the fixed assets tax taxpayer to file a “request for examination” against the Tokyo Metropolitan Government Fixed Assets Evaluation Review Commission within three months of receipt of a Tax Notice after the date (April 3 in FY2023 (R5)) of public announcement on the registration of prices, etc. on the fixed assets tax ledger (however, if the price, etc. is determined or amended after this date, the filing is possible within three months of receiving the Tax Notice on such additional registration). Because the prices in FY2023 (R5) are in principle kept the same as the prices in FY2021 (R3), which was a basic (taxable) year, items that can have requests for examination are limited to the event of dissatisfaction with the newly determined prices resulting from land tract subdivision/consolidation and newly constructed buildings, the event of dissatisfaction with the prices which have been revalued due to changes in land categories and building extensions or renovations or filings stating that this revaluation should be made, and the event of dissatisfaction with land prices that have been amended due to special measures following drops in land prices or filings stating that amendments resulting from applying these special measures should be received. All prices of depreciable properties registered on the fixed assets tax ledger are subject to requests for examination, regardless of the basic (taxable) year.

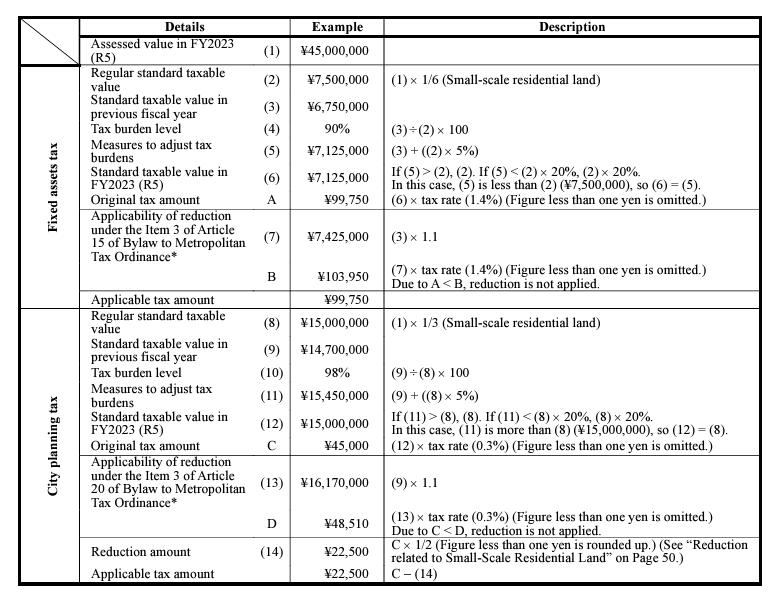

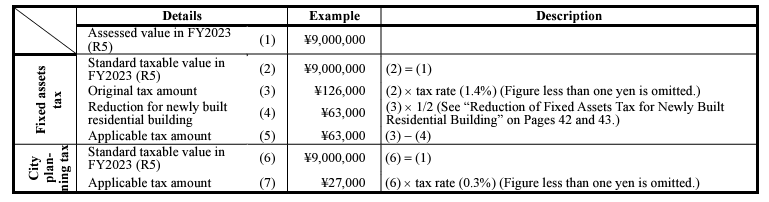

Calculation of Fixed Assets Tax and City Planning Tax

[Example]

A house (two-story and wooden building) was newly constructed on land in one of the 23 special wards in February 2021 (R3). The area of the land is 150 m2, and the floor space is 100 m2. The respective (assessed) values of the land and building are as follows. How should the tax amount for FY2023 (R5) be calculated?

・Land

Value in FY2023 (R5) ……………………………………………………………………….. ¥45,000,000

Property standard taxable value in FY2022 (R4)…………………………….. ¥6,750,000

City planning standard taxable value in FY2022 (R4) ……………………. ¥14,700,000

・Building Value in FY2023 (R5) ……………………………………………………… ¥9,000,000

[Calculation]

・Land

*Reduction under Ordinance Applicable to Lands with the Tax Amounts of more than 110% over the Previous Fiscal Year (See Page 39.) This reduction is only applicable to land lots that did not have the same reduction applied in FY2022 (R4).

・Building

(Note) The above applicable tax amounts are calculated for each land lot and each residential building so it may differ from the actual amount of tax paid as a result of rounding of fraction.